FEATURE10 February 2016

Measuring the immeasurable

x Sponsored content on Research Live and in Impact magazine is editorially independent.

Find out more about advertising and sponsorship.

FEATURE10 February 2016

x Sponsored content on Research Live and in Impact magazine is editorially independent.

Find out more about advertising and sponsorship.

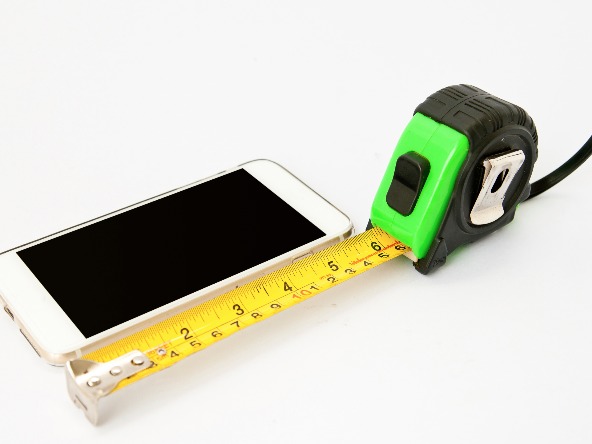

A new passive metering technology that records all of an individual’s digital activity is shedding some interesting light on the difference between what people think they do online, and what they really do. By Ian Ralph

Digital devices are ingrained in the very fabric of our daily lives. We have all read the headlines about how completely we rely on our devices these days, with those terrifying statistics about how many of us sleep with our phones or check Facebook while on the toilet. In theory, there is a wealth of digital information there for the taking by market researchers – information that would be invaluable to brands. It’s accessing such data that is the tricky part.

With behaviour that has become so habitual, pure recall through an online survey can’t give us the full picture. Then there’s the problem of accidental misreporting by those groups who aren’t so comfortable with technology. We also have the thorny issue of whether we want to tell anybody – even an anonymous online survey – about some of our more awkward or embarrassing online activity.

We do still need traditional surveys to understand why people do things and how it makes them feel. But where the usefulness of this technique ends is where the benefits of passive measurement begin.

Reflected Life, an insight tool from ICM Unlimited and Marketing Sciences Unlimited, uses passive metering technology in the form of an app to monitor digital activity continually on a range of devices across a panel of 2,000 UK consumers.

The app is loaded onto any device a panel member owns, including PCs, laptops, tablets and smartphones, and then runs unobtrusively in the background. The tool monitors all activities on those devices – websites visited, apps, device features used – and collates the information to give a complete picture of an individual’s life online. This is

then combined with personal background information and survey results to help brands understand exactly how their customers make decisions online.

When we compared traditional survey data with that collected through Reflected Life, we found that consumers were pretty good at recalling what websites and apps they had used. Where the average person falls down is remembering how they used them.

Despite the slightly guilty expression with which most people discuss their social media use, we actually found that most were over-estimating the length of time spent on these apps. The reality is that people use social media in much shorter bursts than they claim to, dipping in and out throughout the day rather than staying in one app for a long time.

For example, the regular UK Facebook user thinks their average session length is about 17 minutes. The truth is that it’s closer to three minutes long – we forget about all those furtive checks under the restaurant table or the irresistible glance at every notification ‘bleep'. And, despite the strong conviction of the UK public that we use our smartphones primarily during the day and early evening, Reflected Life shows that 14% of YouTube app use happens between midnight and 5am. That’s a lot of humorous cat clips while a partner sleeps. The stark differences between actual and claimed behaviour clearly have huge implications for how brands market their products online.

For example, a leading retail bank wanted to understand better each customer’s online journey when taking out a loan.

We combined qualitative interviews with passive measurement techniques to work out which search terms, websites and apps consumers were using to identify the right product for them, and in what order. By looking at individual loan journeys we were able to see how varying online sources were used together at different stages of the process, and how this varied from person to person. We discovered that most people start with a basic Google search, followed by checking a credible information source, such as moneysavingexpert.com. So far, so predictable.

However, we found that the journey from that point to the lenders’ own sites varied depending on the level of previous loan experience, complexity of the application – such as credit rating – and the urgency of the loan. We also worked out that the majority of these journeys took place either very early in the morning or late at night when people were at home and able to sit at their device alone.

This insight is helping the bank position itself correctly within the digital world and ensuring that its media investment is geared for maximum impact, unhindered by the disparity between actual and claimed behaviour that has dogged market research for so long.

Ian Ralph is a director at Marketing Sciences Unlimited

0 Comments