NEWS18 November 2014

All MRS websites use cookies to help us improve our services. Any data collected is anonymised. If you continue using this site without accepting cookies you may experience some performance issues. Read about our cookies here.

All MRS websites use cookies to help us improve our services. Any data collected is anonymised. If you continue using this site without accepting cookies you may experience some performance issues. Read about our cookies here.

UK — Supermarket shopping and comparison website mySupermarket has launched mySupermarket Insights.

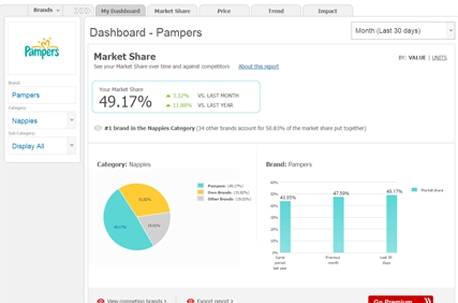

A real-time dashboard tracks product sales and market share across all the main supermarkets in the UK allowing marketers to track performance and make changes daily to their campaigns rather than waiting for post-season analysis.

The data is gathered from more than 50,000 unique monthly shoppers and 4.5 million visitors to the site. MySupermarket Insights will also be able to track promotions, market share, NPD, purchasing trends and access to customer’s opinions and feedback with custom surveys.

It will include a freemium model for an indefinite period of time giving users access to 30 days worth of market share. For a monthly payment, users can access more in-depth data and detailed reports covering inflation tracking and NPD daily alerts.

Gilad Simhony, CEO of mySupermarket, said: “For too long the FMCG sector has had to make important business decisions based on data that is at best weeks old. MySupermarket Insights is a unique real-time measurement of brand performance for the FMCG community. By tracking sales of specific products or categories, marketers will be able to directly link the performance of their marketing campaign and the impact on market share.”

Newsletter

Sign up for the latest news and opinion.

You will be asked to create an account which also gives you free access to premium Impact content.

Media evaluation firm Comscore has increased its revenue in the second quarter but has made a net loss of $44.9m, a… https://t.co/rAHZYxiapz

RT @ImpactMRS: Marginalised groups are asserting themselves in Latin America, with diverse creative energy and an embrace of indigenous cul…

There is no evidence that Facebook’s worldwide popularity is linked to widespread psychological harm, according to… https://t.co/wS1Um3JRS5

The world's leading job site for research and insight

Resources Group

Qualitative Senior Research Exec – London / Hybrid working

Up to circa £35,000 + Benefits

Resources Group

Project Manager – Quantitative – Dynamic Boutique Agency

£30–40,000 + good benefits

Spalding Goobey Associates

Senior Research Executive, Mixed Methods – Technology and IT

£Excellent Package

Featured company

Town/Country: London, ,

Email: helloUK@opinium.com

Opinium is an award winning strategic insight agency built on the belief that in a world of uncertainty and complexity, success depends on the ability to stay on the pulse . . .

Town/Country: Aylesbury

Email: enquiries@2-europe.com

2Europe is an award-winning (Quirk's, RAR Awards), full-service market research agency which specialises in international B2B market research. We are recognised as one of the top market research agencies in the UK . . .

Peter Giles

11 years ago

Supermarkets have a range of at least 40,000 SKU's so how is mysupermarket able to give sales marketshare with only 50,000 shoppers? The sales threshold would have to very low on most products with only the most popular items being reported on in significant numbers to be statistically representative. Also, sales differ between online shopping and offline shopping so you wouldn’t be able to extrapolate this to offline at all as the baskets differ. Online grocery sales still only make up about 7% of total sales so not sure how relevant this data is.

Brought to you by:

©2025 The Market Research Society,

15 Northburgh Street, London EC1V 0JR

Tel: +44 (0)20 7490 4911

info@mrs.org.uk

The post-demographic consumerism trend means segments such age are often outdated, from @trendwatching #TrendSemLON

1 Comment

Peter Giles

11 years ago

Supermarkets have a range of at least 40,000 SKU's so how is mysupermarket able to give sales marketshare with only 50,000 shoppers? The sales threshold would have to very low on most products with only the most popular items being reported on in significant numbers to be statistically representative. Also, sales differ between online shopping and offline shopping so you wouldn’t be able to extrapolate this to offline at all as the baskets differ. Online grocery sales still only make up about 7% of total sales so not sure how relevant this data is.

Like Reply Report